Liquidity Solutions

Tech-Focused Finance Broker.

We secure the funding your business needs, borrow up to £100,000

With access to over 100 B2B lenders, we’ll find the best loan or finance solution for you.

With access to over 100 B2B lenders, we’ll find the best loan or finance solution for you.

Finding the right finance for your business shouldn’t be a full-time job. That’s where we come in.

We help you track down the best finance options and the right deal—without costing you a penny.

Let’s be honest: searching for business finance can be overwhelming. With so many options out there, how do you know you’re getting the best deal? And do you really have the time to sift through it all?

That’s why businesses turn to us.

Our smart matching system connects you with a range of lenders, and from there, we use our experience to find the best fit for your business. We talk to lenders every day, so we know exactly where the best deals are right now.

And because we’re completely independent, we’re not tied to any one lender. Our priority? Getting you the right solution, not just any solution.

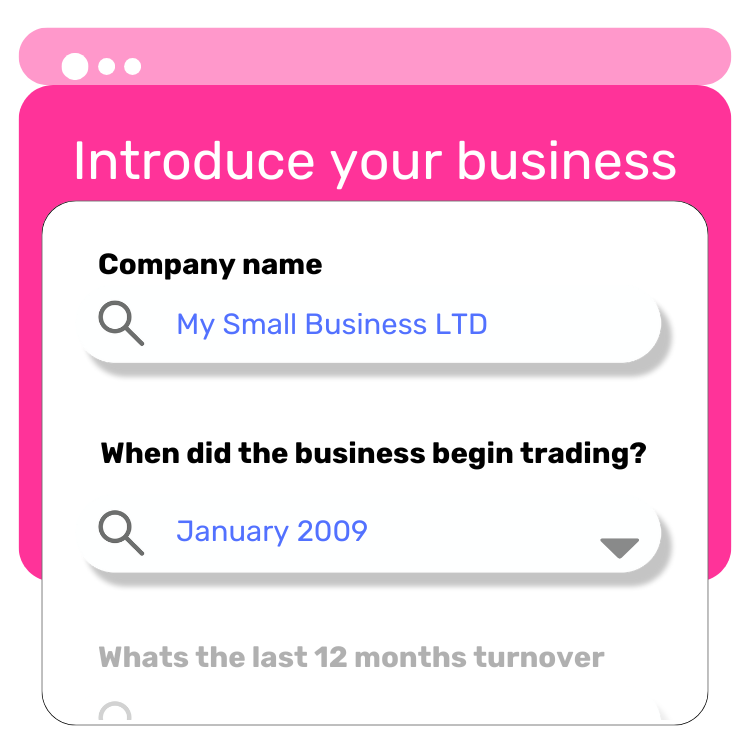

Start by submitting your application on our website—quick and easy!

We scan our panel of trusted lenders to find the one that best fits your needs.

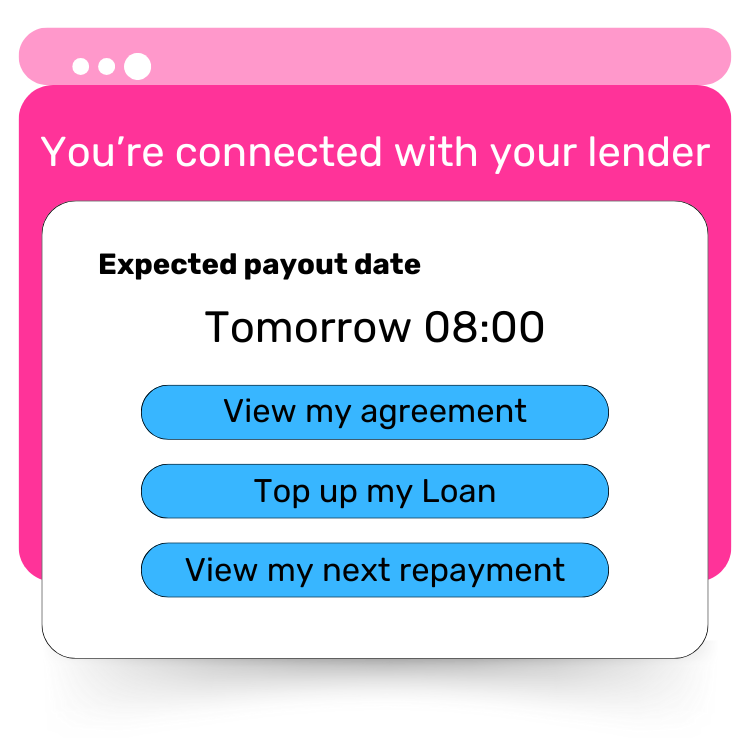

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.

A finance broker can save you time and effort by doing the heavy lifting to find the best funding options for your business. They have access to a wide network of lenders and know which ones are most likely to approve your application based on your needs and circumstances. Plus, brokers offer expert advice to help you understand your options and secure a deal that works best for your business, often at no extra cost to you.

Yes, we can absolutely help! Banks often have strict criteria, and being turned down doesn’t mean you’re out of options. We work with over 100 lenders, including many who specialise in helping businesses that have been declined by traditional banks. We’ll assess your situation, explore alternative funding options, and match you with a lender who understands your needs.