Hire Purchase

Hire Purchase is a type of asset finance that allows businesses to acquire essential equipment, vehicles, or machinery without having to pay the full cost upfront. Instead, you can pay a deposit followed by fixed monthly instalments over an agreed time period. At the end of the term, once all payments have been made, ownership of the asset is transferred to your business.

How Does Hire Purchase Work?

1

Choose Your Asset

Identify the equipment, vehicle, or other business asset you need.

2

Agree on Terms

Work with a finance provider to set the deposit amount, repayment schedule, and length of the agreement.

3

Make Regular Payments

Spread the cost over fixed monthly instalments, helping you manage cash flow more effectively.

4

Own the Asset

Once you have completed all payments, you become the legal owner of the asset.

Key Benefits of Hire Purchase

Is Hire Purchase Right for Your Business?

Hire Purchase can be an attractive option if you:

- Prefer eventually owning your asset outright, rather than renting or leasing.

- Need to spread the cost of critical equipment over time to conserve working capital.

- Require predictable monthly outgoings for easier budget management.

- Want to avoid using existing lines of credit or short-term funding sources for large capital expenditures.

If you are looking for a straightforward, long-term way to finance major business assets, Hire Purchase might be the solution. Need a small business loan instead, hit the ‘Start Application Today‘ button below.

Start Application Today

Comparing Hire Purchase with Other Finance Options

Hire Purchase vs. Leasing

Leasing typically involves paying for use of an asset over a contract period without gaining ownership. With Hire Purchase, you’ll own the asset at the end.

Hire Purchase vs. Business Loan

A business loan provides a lump sum that can be used for various purposes, whereas Hire Purchase funding is directly tied to acquiring a specific asset.

Hire Purchase vs. Operating Lease

An operating lease often has lower monthly payments because you only pay for the asset’s depreciation rather than its total value, but you don’t own it at the end.

How does a Liquidity business loan work?

1

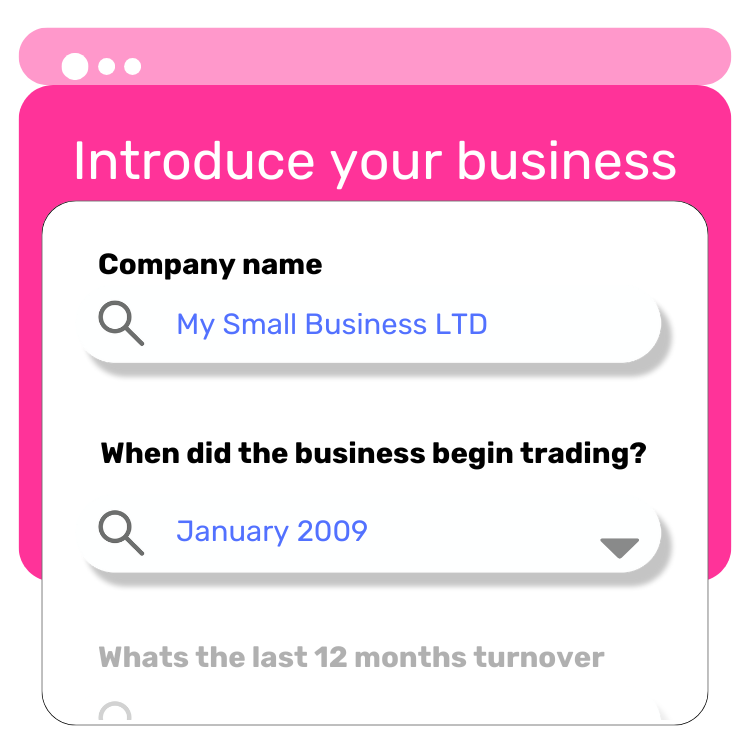

Apply Online

Start by submitting your application on our website, quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

3

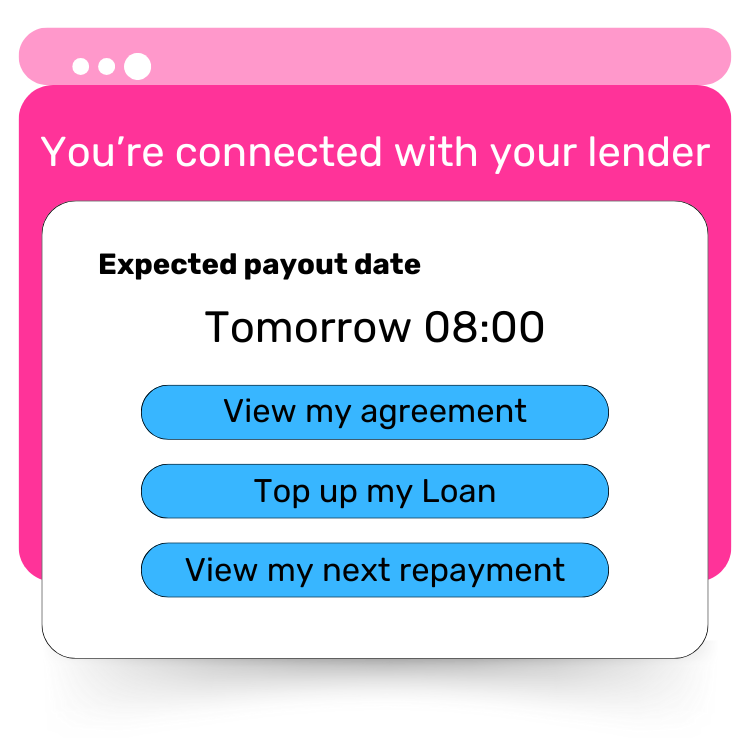

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.

How Liquidity Solutions Can Help

At Liquidity Solutions, we specialise in flexible financing options designed to help your business grow. Our simple and easy application can:

- Assess your needs and financial situation.

- Provide available terms and repayment structures.

- Guide you through the application process swiftly and efficiently.

With our extensive knowledge and commitment to customer care, we aim to find the Hire Purchase agreement that best suits your business objectives and cash flow requirements.

If you believe Hire Purchase could be the right fit for your business, contact Liquidity Solutions today. Get in touch to learn more about how our Hire Purchase solutions can equip your business with the assets it needs for long-term success.