How to Build a Business Plan for Loan Approval

Creating a robust business plan is crucial for securing a business loan in the UK. Lenders require a comprehensive document that outlines your business’s objectives, strategies, financial projections, and repayment plans. Here’s a step-by-step guide to crafting a compelling business plan tailored for loan approval

Executive Summary

Begin with a concise overview of your business, capturing the essence of your plan to engage lenders. Include:

Business Name & Location: Clearly state your company’s legal name and registered address.

Products or Services: Summarise what your business offers and its unique selling propositions.

Target Market: Describe your primary audience, including demographics and purchasing behavior.

Loan Details: Specify the loan amount requested, its intended use, and how it will facilitate business growth

A well crafted executive summary should entice the lender to delve deeper into your plan

Business up and running? Apply For Finance Here

Business Description

Provide a detailed introduction to your company, highlighting its uniqueness. Cover:

- Business Structure – Explain whether your company operates as a sole trader, limited company, partnership, or another structure.

- Industry Overview – Offer insights into your industry, including trends and key players.

- Unique Selling Points (USPs) – Highlight what differentiates your business from competitors.

- Company History & Milestones – Outline significant achievements or events in your business journey.

This section should demonstrate your business’s viability and potential for success.

Helpful Resource: GOV.UK- Set Up a Business

Need Business Finance?

Market Research & Competitor Analysis

Showcase the demand for your product or service through thorough research. Include:

- Target Audience – Detail your ideal customers, their needs, and buying habits.

- Market Size & Trends – Use statistics to illustrate industry growth and opportunities.

- Competitor Analysis – Evaluate direct and indirect competitors, their strengths, and weaknesses.

- Market Gaps & Opportunities – Explain how your business addresses unmet needs in the market.

A deep understanding of your market reassures lenders of your business’s potential.

Helpful Resource: Office for National Statistics- UK Business Data

Need Help? Let Us Help You Find The Loan You Need

Business Model & Revenue Streams

Clarify how your business generates revenue and achieves profitability. Discuss:

- Primary Revenue Streams – Outline main income sources, such as product sales or services.

- Pricing Strategy – Justify your pricing based on market demand and cost analysis.

- Sales & Distribution Channels – Describe how your offerings reach customers.

- Growth Strategy – Provide insights into plans for expansion and increased revenue.

A well-defined business model demonstrates financial sustainability.

Helpful Resource: Start Up Loans- Business Plan Guide

Need Start Up Funds?

Financial Projections

Present realistic financial forecasts to showcase your business’s financial health. Include:

- Cash Flow Forecast – Break down expected revenue and expenses over the next 12-24 months.

- Profit & Loss Statements – Project income statements detailing revenue and costs.

- Break-even Analysis – Indicate when your business is expected to become profitable.

- Loan Repayment Plan – Explain how you will utilise the loan and plan for repayment.

Accurate financial projections build lender confidence in your repayment ability.

Find Out More

Funding Request & Loan Repayment Plan

The Loan Amount You Need

Specify the exact amount you’re requesting and break down how you intend to use the funds.

Purpose of the Loan

Explain whether the funds will be used for equipment, stock, expansion, working capital, or other business needs.

Repayment Terms

Detail how you will repay the loan, including expected monthly payments, interest rates, and time frame.

Risk Mitigation Plan

Address potential financial risks and how you plan to overcome them.

Management & Team

Introduce the individuals behind your business. Include:

- Key Team Members – Highlight experience, skills, and qualifications.

- Organisational Structure – Provide an overview of your company’s hierarchy.

- Advisors & Mentors – Mention any external support aiding business growth.

A competent team enhances the credibility of your business plan.

Helpful Resource: King’s Trust- Business Planning

How does a Liquidity business loan work?

1

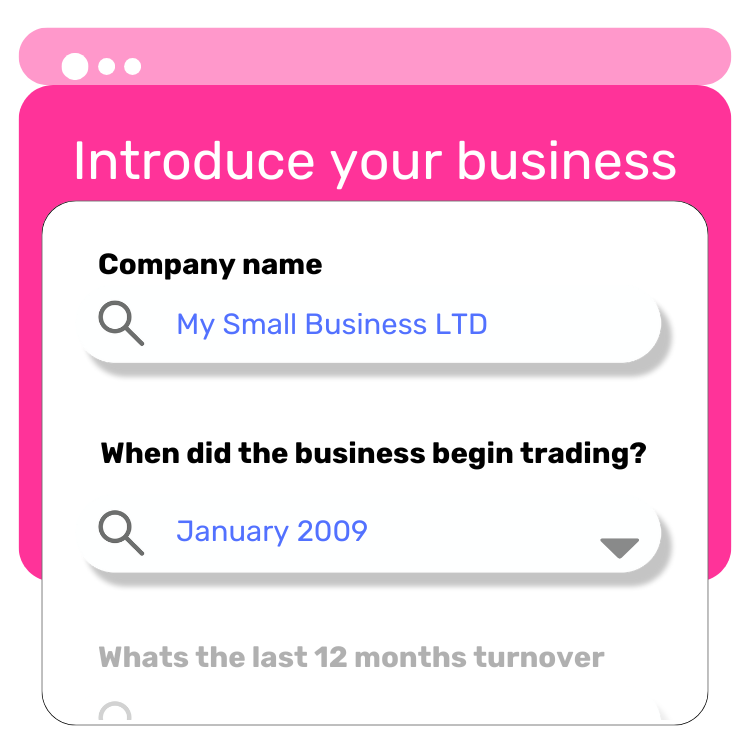

Apply Online

Start by submitting your application on our website—quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

3

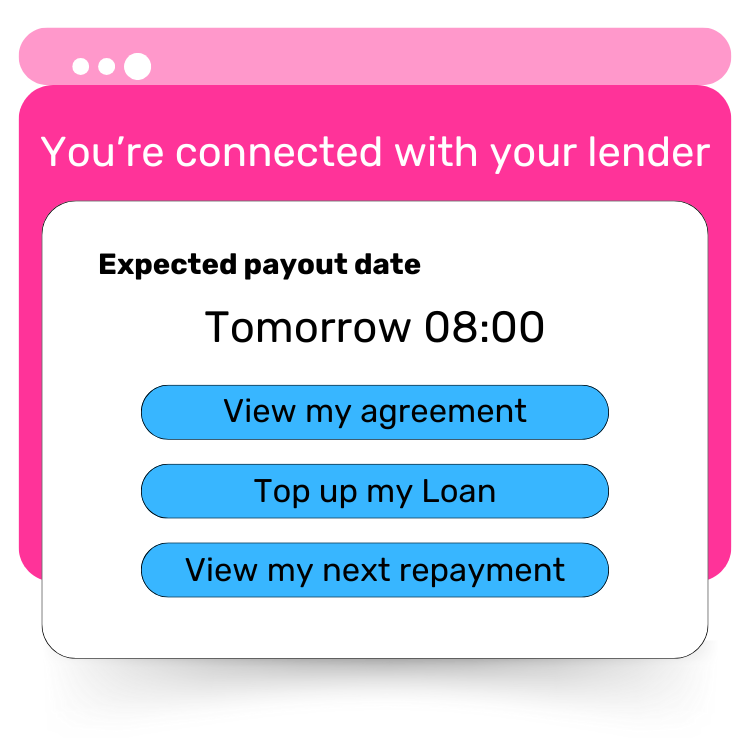

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.

A well-structured business plan not only improves your chances of securing a loan but also serves as a valuable guide for your business growth. Use the links above to access templates and expert advice to help you get started. If you need more help, consider reaching out to a business mentor or an organisation like the Federation of Small Businesses (FSB) for guidance on funding and planning.

Need assistance with your business plan or loan application? Contact our experts at Liquidity Solutions for tailored guidance to your business needs.