How to Choose the Right Business Loan: A Comprehensive Guide

Running a business requires capital, and at some point, most business owners will need to seek external financing to achieve their goals. With so many loan options available, choosing the right one can feel overwhelming. This guide will walk you through the different types of business loans and help you identify the best fit for your needs. Let’s explore the different business loan options here.

Understanding Different Types of Business Loans

Asset Finance

If your business needs to purchase expensive equipment, machinery, or vehicles, Asset Finance is a great option. This loan allows you to spread the cost of these purchases over time, preserving your cash flow while still acquiring the tools you need to operate and grow your business.

Best for:

- Purchasing equipment, machinery, or vehicles.

- Businesses with predictable income that can handle structured repayments.

Apply For Asset Finance

Business Debt Refinancing

Managing multiple loans can strain your cash flow. Business Debt Refinancing consolidates your existing debts into a single loan with more favorable terms. This option can reduce monthly payments, simplify management, and even save you money in the long term.

Best for:

- Businesses with multiple loans or high-interest debt.

- Companies looking to simplify their finances or reduce costs.

Apply Today

Business Expansion Loans

Planning to open a new location, hire more staff, or invest in growth opportunities? Business Expansion Loans are specifically designed to provide the capital needed for scaling your business operations.

Best for:

- Expanding physical locations or services.

- Financing growth initiatives, such as marketing campaigns or new product launches.

Expand My Business Today

Commercial Business Loans

For larger, long-term financing needs, Commercial Business Loans offer substantial funding with flexible repayment options. These loans can be used for anything from property purchases to major infrastructure investments. Liquidity Solutions can help you apply for a business loan.

Best for:

- Large-scale projects or investments.

- Businesses that need significant funding with longer repayment terms.

Not what you need? Small Business Loans instead?

Invoice Finance

Struggling with cash flow due to unpaid invoices? Invoice Finance lets you access a percentage of your unpaid invoices upfront. Once your client pays the invoice, you’ll receive the remaining amount minus fees.

Best for:

- Businesses with long payment cycles.

- Companies needing quick access to working capital.

Need an invoice covered?

Merchant Cash Advance

A Merchant Cash Advance (MCA) isn’t a traditional loan but rather a cash advance repaid through a percentage of your daily sales. This option is ideal for businesses with fluctuating revenue streams.

Best for:

- Retail or service businesses with consistent credit card sales.

- Companies needing fast, flexible financing.

Apply Now

Revenue-Based Loans

Similar to MCAs, Revenue-Based Loans allow you to borrow funds and repay them as a percentage of your monthly revenue. Unlike MCAs, these loans often offer lower fees and a more structured repayment system.

Best for:

- Businesses with seasonal or variable income.

- Companies looking for repayment flexibility.

Low Fee Revenue Based Loans? Apply Today

Small Business Loans

Small Business Loans are versatile and can be tailored to suit a variety of business needs, from startup costs to daily operations. These loans often come with competitive interest rates and flexible terms.

Best for:

- Startups or small businesses looking for general-purpose funding.

- Companies that meet the lender’s eligibility criteria (often including a solid business plan and good credit).

Ready to Apply?

Working Capital Loans

If you’re looking for funds to cover day-to-day expenses, Working Capital Loans are designed to provide short-term cash flow relief. These loans are ideal for managing seasonal fluctuations or unexpected expenses.

Best for:

- Businesses experiencing temporary cash flow gaps.

- Companies that need short-term financing for operational expenses.

Need Funds Today? Apply Here

Choosing the right business loan is a crucial decision that can impact your business’s success and growth. Whether you need to purchase equipment, manage cash flow, or expand operations, there’s a loan designed for your specific needs. Take the time to research your options, understand the terms, and select a loan that sets your business up for long-term success.

If you’d like more information on any of these loan types, check out our dedicated pages for Asset Finance, Business Debt Refinancing, Business Expansion Loans, Commercial Business Loans, Invoice Finance, Merchant Cash Advance, Revenue-Based Loans, Small Business Loans, and Working Capital Loans.

How does a Liquidity business loan work?

1

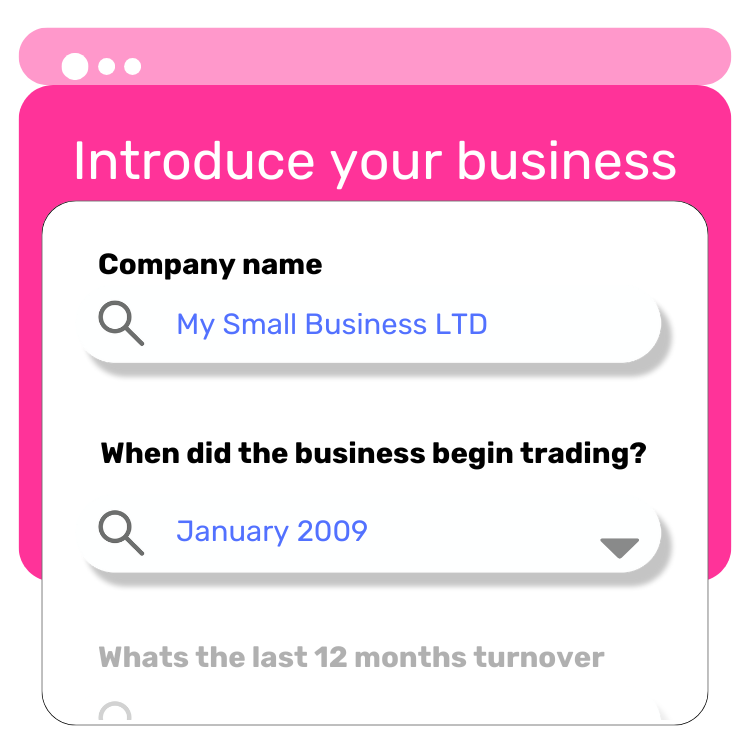

Apply Online

Start by submitting your application on our website—quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

3

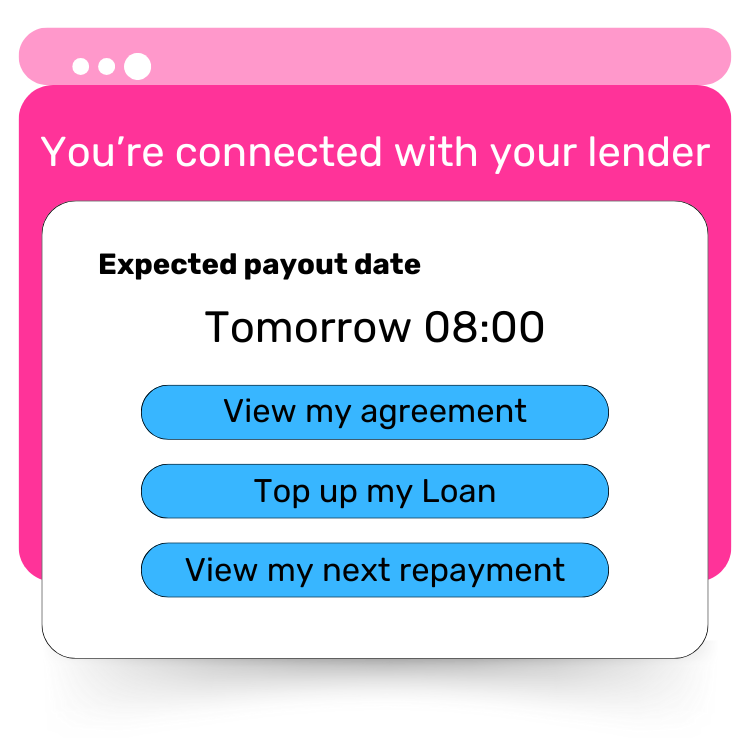

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.