How to Effectively Budget for Major Spring Investments

Spring brings a renewed sense of opportunity and growth, making it the ideal time for businesses to invest in new projects, upgrades, and expansions. However, making major investments requires a well-planned budget that aligns with your financial goals. In this blog, we discuss effective budgeting strategies to ensure that your spring investments drive growth without jeopardising your cash flow.

Understand Your Investment Needs

Start by clearly identifying the areas where you need to invest. Whether it’s upgrading equipment, expanding your premises, or launching a new product, having a detailed list will help you prioritise your spending. Take a close look at your business plan and ask:

A clear understanding of your needs forms the foundation of an effective budget.

Invest In Your Business Today

Set Clear and Realistic Goals

Before you allocate funds, set specific investment goals that are both measurable and achievable. This includes:

- Defining Objectives: Determine what each investment should achieve, such as increased production capacity or improved customer experience.

- Establishing Timelines: Align your investment timeline with the spring season to take advantage of market opportunities.

- Allocating Resources: Identify the available capital and determine how much you can commit without straining your operational budget.

Prioritise and Plan Your Investments

Immediate Impact Investments

Not all investments are created equal. It is essential to prioritise those that offer the highest return on investment or have the potential to drive significant growth. Consider:

- Immediate Impact Investments: Focus on areas that provide quick wins.

- Long-Term Growth: Allocate funds for investments that may take longer to yield results but offer sustainable benefits.

- Risk vs Reward: Balance high-risk ventures with more secure investments to maintain financial stability.

Create a timeline that maps out when each investment will be made and how funds will be allocated across different projects.

Leverage Small Business Loans to Fuel Growth

For many businesses, available capital may not be enough to cover all major investments. This is where small business loans can play a crucial role. A well-structured loan can help you:

- Bridge the Funding Gap: Secure the necessary funds to make high-priority investments without compromising day-to-day operations.

- Improve Cash Flow: Consolidate your spending into a manageable repayment plan with competitive interest rates.

- Accelerate Growth: Enable you to invest in opportunities that can drive immediate revenue, positioning your business for long-term success.

Find out if your eligible for a Small Business Loan with Liquidity Solutions

Get In Touch Today

Monitor Your Budget and Adjust Accordingly

Budgeting is not a one-time task. It requires ongoing monitoring to ensure that your spending aligns with your objectives. Consider the following steps when monitoring your budget.

You should regularly review expenses. Make sure you check your progress against your set goals. It is important to be prepared for any changes from unexpected costs or opportunities and if you want to stay ahead of the curve, leverage budgeting software and other finance dashboards to keep real-time tabs on your spending.

By monitoring your budget, you can make timely decisions that keep your investments on track and maximise their return.

How does a Liquidity business loan work?

1

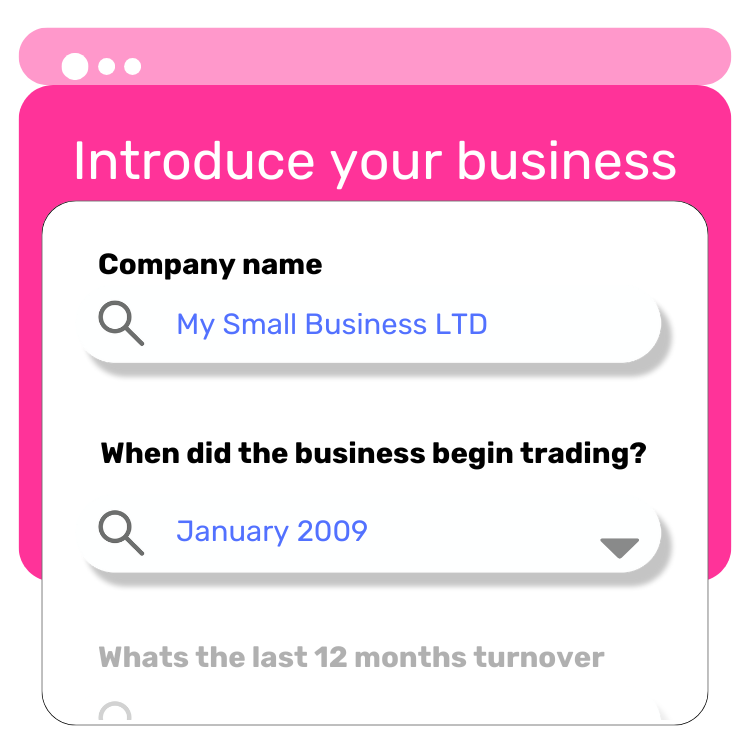

Apply Online

Start by submitting your application on our website, quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

3

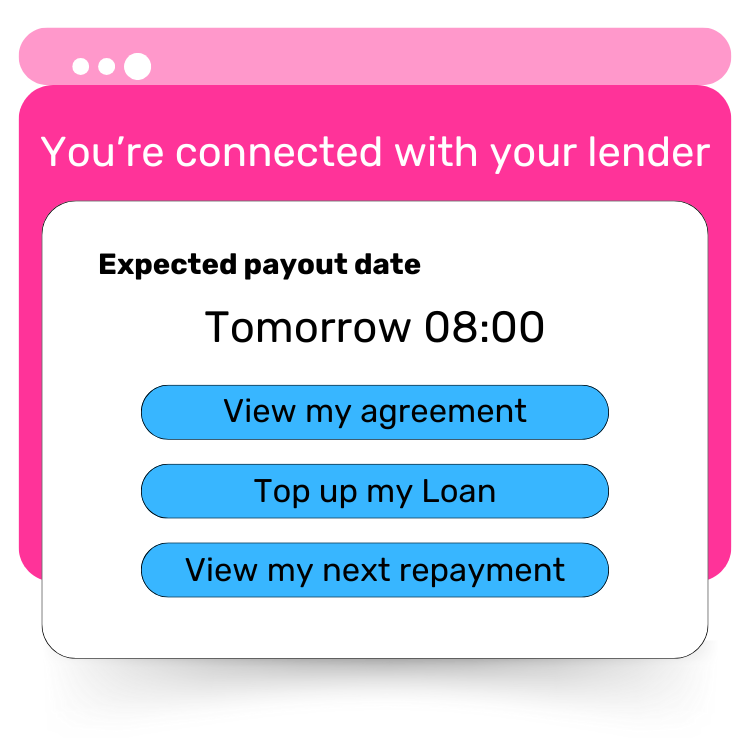

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.

Conclusion

Effectively budgeting for major spring investments involves a clear understanding of your needs, setting realistic goals, and prioritising investments based on their potential impact. With the added benefit of small business loans, you can secure the funds necessary to bridge any gaps in your capital, ensuring that your investments drive growth without overextending your resources. Start planning today to make the most of the opportunities that spring offers.