Practical Strategies for Reducing Business Debt in 2025

In 2025, many businesses face mounting debt and financial pressures. However, with careful planning and the right financial tools, you can reduce your business debt and set the stage for long-term growth. In this blog, we explore a range of practical strategies, including the role of small business loans, to help you regain control of your finances.

Assess Your Financial Health

Before you can reduce debt, it is essential to evaluate your current financial situation. Start by performing a comprehensive review of your accounts to understand where your money is going. Ask yourself:

- What are my current debt obligations?

- Which loans or credit lines carry the highest interest rates?

- Are there any unnecessary expenses that can be trimmed?

By answering these questions, you lay the foundation for a debt reduction strategy. For further guidance on managing business finances, visit the UK Government Business Support page.

Apply For A Small Business Loan

Renegotiate Terms and Reduce Expenses

One effective approach to reducing debt is to renegotiate the terms of existing loans and cut non-essential spending. Consider these steps:

- Talk to Your Lenders: Request lower interest rates or more flexible repayment terms.

- Audit Your Expenses: Identify areas where you can cut costs without affecting business operations.

- Streamline Operations: Adopt efficient processes that reduce waste and save money.

Improving operational efficiency not only lowers expenses but also increases the cash flow available for debt repayment.

Use Small Business Loans to Consolidate Debt

Focus on Revenue Growth and Cash Flow

While cutting costs is important, increasing revenue is another vital strategy for reducing debt. Look for ways to boost your income by:

Diversifying your product or service offerings.

Expanding into new markets.

Improving your marketing efforts to attract more customers.

Investing in strategies that enhance revenue can provide the additional cash flow needed to pay down debt faster.

Seek Professional Financial Advice

Sometimes, the best way to manage business debt is to consult with a financial advisor who specializes in business finance. Professional advice can help you:

- Develop a tailored debt reduction plan.

- Identify opportunities for refinancing or restructuring your debt.

- Avoid common pitfalls and make informed decisions.

Working with experts ensures that you have a comprehensive strategy to tackle your financial challenges effectively.

How does a Liquidity business loan work?

1

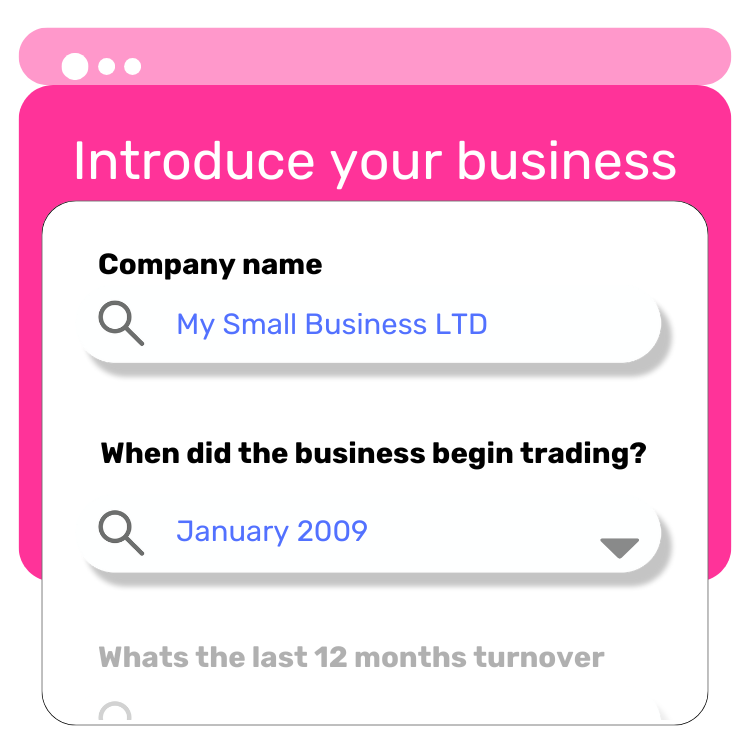

Apply Online

Start by submitting your application on our website, quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

3

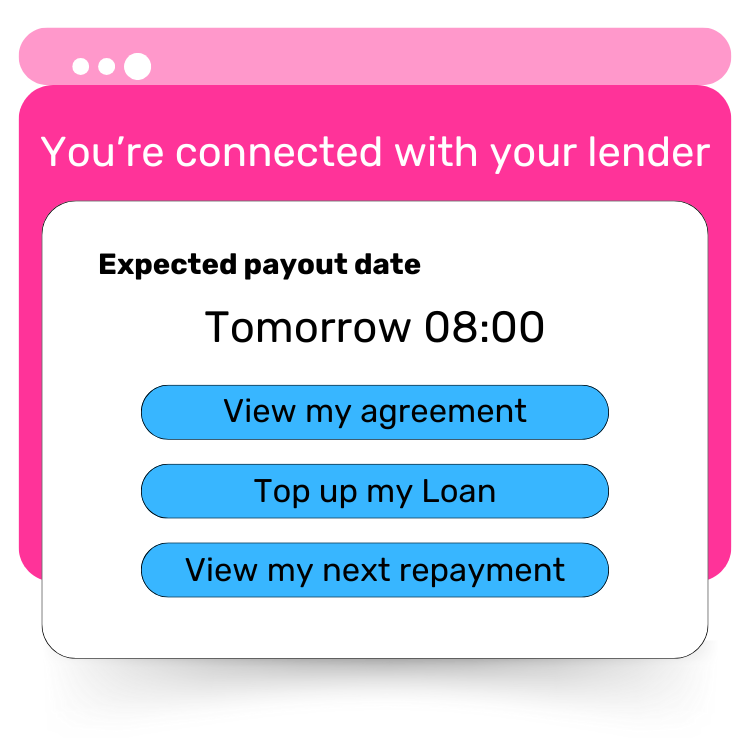

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.