Proven Strategies to Secure Business Loan Approval

Getting approved for a business loan can feel like a challenge, but with the right preparation, you can increase your chances of success. Lenders want to feel confident that you’re a low-risk borrower who can repay the loan on time. By presenting yourself and your business in the best possible light, you’ll be more likely to secure the funding you need. Here are some practical steps to improve your odds of approval.

Understand Loan Requirements

Different loans have different requirements, and lenders will look for specific criteria based on the loan type. Before you apply, research the loan’s eligibility criteria. For example:

Matching your business needs to the right loan type can improve your chances of business loan approval.

Apply for funding now

Check and Improve Your Credit Score

Your credit score is a key factor that lenders consider. A strong personal and business credit score shows that you’re responsible with debt. Looking after your credit score can enhance loan eligibility.

Tips for Improving Your Credit:

- Pay your bills on time, including credit card and utility payments.

- Reduce existing debt levels to improve your credit utilisation ratio.

- Dispute any inaccuracies on your credit report.

If your credit score isn’t where it needs to be, consider waiting to apply until you’ve improved it.

Apply for Small Business Loan Today

Organise Essential Financial Documents

Lenders will want to see a clear picture of your business’s financial health. Be prepared to provide:

- Tax returns (usually for the past 2-3 years).

- Income statements, balance sheets, and cash flow statements.

- Bank statements for the last few months.

Organizing these documents beforehand shows you’re serious and makes the process smoother. Getting this process right at the beginning will help improve your loan application.

Sorted? Get Your Loan Today

Develop a Comprehensive Business Plan

A well-thought-out business plan can make a big difference. It shows lenders you’ve thought through your goals and have a clear strategy for using the loan.

What to Include in Your Business Plan:

- An overview of your business and its mission.

- Market research and competitive analysis.

- Revenue projections and a detailed explanation of how you’ll use the loan.

A strong plan not only improves your chances of business loan approval, but also ensures you’re borrowing for the right reasons.

Get Business Finance

Demonstrate Stable Cash Flow

Lenders want to know you have the ability to repay the loan. Showing a history of stable cash flow reassures them that your business is financially healthy.

How to Improve Your Cash Flow:

- Follow up on unpaid invoices promptly.

- Reduce unnecessary expenses.

- Focus on generating consistent sales.

Highlighting consistent income in your application can make you a more attractive borrower.

Apply Today

Consider Offering Collateral

If you’re applying for a secured loan, offering collateral can strengthen your application significantly. Collateral is an asset that you pledge to the lender as security in case you’re unable to repay the loan.

Types of Collateral to Consider:

- Equipment or Machinery: If your business owns valuable machinery or equipment, these can serve as collateral.

- Real Estate or Property: Commercial or personal property can provide a strong security for the loan.

- Receivables: Unpaid invoices or expected revenue can also be pledged in some cases.

Offering collateral reduces the risk for the lender, making it more likely that they’ll approve your loan. However, keep in mind that failing to repay the loan could result in losing the assets you pledged, so make sure you’re confident in your repayment ability.

Ready for a loan now?

Find the Right Lender

Not all lenders are the same, and some specialize in certain types of businesses or loans. Research lenders to find one that aligns with your industry and needs.

Types of Lenders:

- Traditional Banks: Best for established businesses with strong credit.

- Online Lenders: Often more flexible with faster approvals.

- Alternative Lenders: Ideal for unique financing needs, like a Merchant Cash Advance or Invoice Finance.

We would recommend using a brokerage like Liquidity Solutions. We have access to a panel of lenders which could speed up your search for funds. Why not take a look at our blog about Common Mistakes in Business Loan Applications whilst your here.

Apply with Liquidity Solutions

Apply for the Right Loan Amount

Borrowing the right amount is crucial for securing a loan and demonstrating your preparedness to lenders. Requesting an amount that aligns closely with your business’s needs and repayment capacity is essential.

- Borrowing too much may raise concerns for lenders, as it can suggest potential difficulties in repayment.

- Borrowing too little could imply that you haven’t fully considered the financial requirements of your business, potentially undermining your credibility.

To avoid these pitfalls, take the time to carefully calculate your business’s financial needs. Clearly justify the requested loan amount with a detailed plan, ensuring it reflects both your goals and your ability to manage repayments.

Apply for £5000 Today

Securing a business loan takes preparation and effort, but by following these steps, you’ll improve your chances of success. Focus on building a strong application, demonstrating financial stability, and finding the right lender for your needs. Whether you’re applying for a Small Business Loan, Working Capital Loan, or Revenue-Based Loan, preparation is the key to getting approved and setting your business up for success. For some further reading, take a look at the governments New Business Growth Service

How does a Liquidity business loan work?

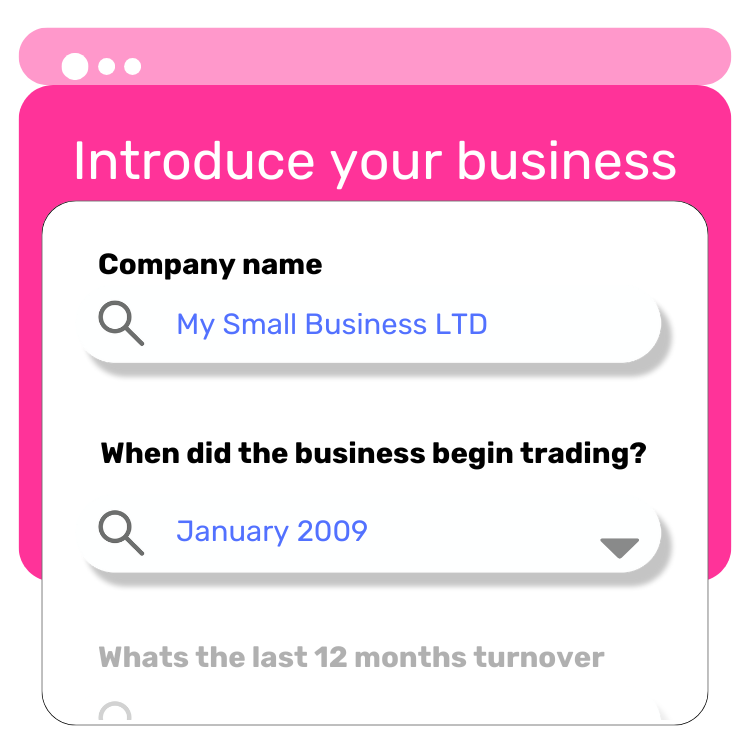

1

Apply Online

Start by submitting your application on our website—quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

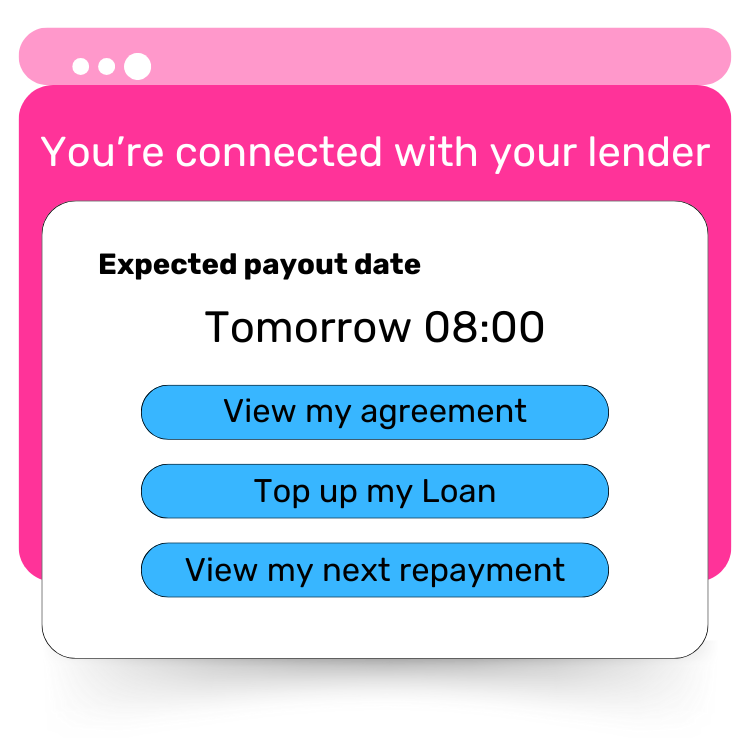

3

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.