Top 5 Mistakes Small Business Owners Make When Applying for a Loan (and How to Avoid Them)

Applying for a small business loan can be a game-changer, providing the necessary funds for growth, expansion, or managing cash flow. However, many small business owners make critical mistakes that can lead to loan rejections, higher interest rates, or unfavourable terms. Avoiding these pitfalls can improve your chances of securing the financing you need.

Not Understanding Your Credit Score and Financial Health

Lenders assess your credit score and financial records before approving a loan. A low credit score, outstanding debts, or inconsistent cash flow can raise red flags.

How to Avoid This Mistake:

- Check your credit score before applying and correct any errors.

- Pay down outstanding debts to improve your financial standing.

- Maintain a clear and organised financial record to present to lenders.

Apply Today

Applying for the Wrong Type of Loan

Not all business loans are the same. Some loans are short-term, while others require collateral or specific qualifications. Applying for the wrong one can lead to unnecessary rejections or higher costs.

How to Avoid This Mistake:

- Research different types of small business loans available in the UK (Government Start Up Loans, term loans, business lines of credit, invoice financing, asset finance, etc.).

- Determine which loan best fits your business needs before applying.

- Consult with a financial adviser or lender to explore your best options.

Find Out If Your Eligible

Incomplete or Inaccurate Loan Applications

Many business owners rush the loan application process, leading to missing information, errors, or incomplete documentation—all of which can delay approval or result in rejection.

How to Avoid This Mistake:

- Carefully review all required documents before submission.

- Provide complete and accurate financial statements, tax returns, and business plans.

- Double-check your application for errors before submitting it.

Need Help? Let Us Help You Find The Loan You Need

Overlooking Loan Terms and Hidden Fees

Focusing only on the loan amount and interest rate can lead to financial surprises later. Some loans have hidden fees, penalties, or unfavourable repayment terms.

How to Avoid This Mistake:

- Read the full loan agreement carefully before signing.

- Ask about any additional fees, early repayment penalties, or variable interest rates.

- Work with a trusted financial adviser or legal expert to review loan terms.

Apply Today

Not Having a Clear Repayment Plan

Even if a lender approves your loan, failing to plan your repayment strategy can lead to financial strain, missed payments, and potential defaults.

How to Avoid This Mistake:

- Calculate the monthly repayments and ensure they align with your cash flow.

- Set up automated payments to avoid late fees.

- Have a contingency plan in place for slow business periods.

Find Out More

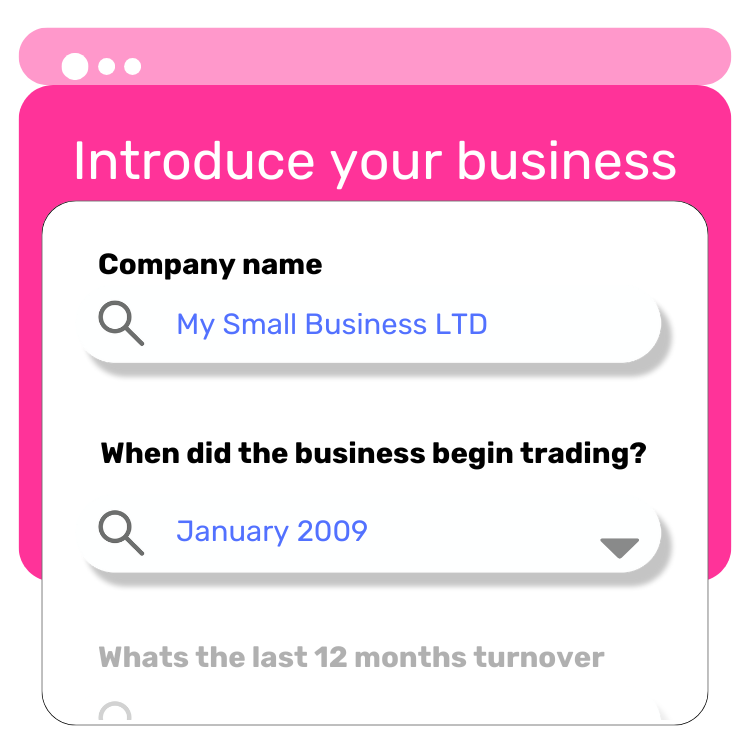

How does a Liquidity business loan work?

1

Apply Online

Start by submitting your application on our website—quick and easy!

2

We Search for the Best Lender

We scan our panel of trusted lenders to find the one that best fits your needs.

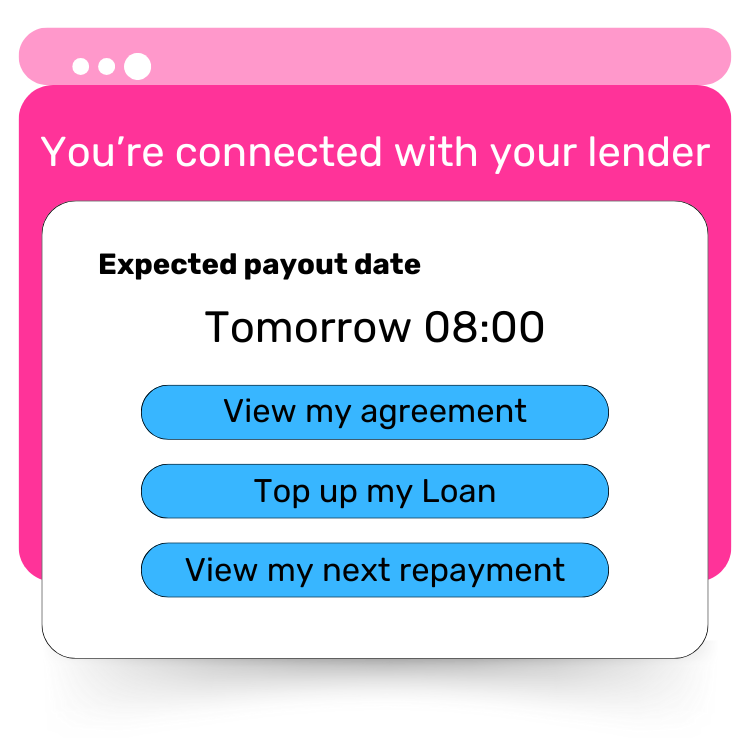

3

Connect with Your Lender

We introduce you to the lender, and they’ll take it from there to complete your application. You could get funds in as little as 24 hours.

Final Thoughts

Securing a business loan doesn’t have to be a daunting process. By avoiding these common mistakes, you can improve your chances of approval, secure better loan terms, and ensure financial stability. Prepare your financials, choose the right loan, and carefully review terms to make the most of your funding opportunity.

Need help finding the right business loan? Apply for a small business loan with Liquidity Solutions tailored to your business needs.